Answer:

14%

Step-by-step explanation:

Let b = standard deviation of B

a = standard deviation of portfolio A

r = the correlation coefficient of both portfolios

We shall then proceed by calculating the weights for the optimal risky portfolios as:

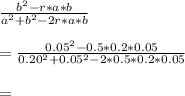

W1 =

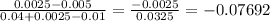

=

W2 = 1- W1 = 1- (-0.07692)

= 1 + 0.07692 = 1.07692

We shall then calculate the expected return for the optimal risky portfolio as

E(r) = W2R2 + W1R1

= (1.07692*0.14) + (-0.07692 *0.18)

=0.15076 -0.01384

= 0.1369

= 0.1369* 100 = 13.69%

= 14%