Answer:

The retirement fund will last for 33 years and 7 months

Step-by-step explanation:

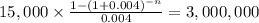

We need to solve for time in an ordinary annuity

C $15,000.00

rate 0.004 (4.8% divide by 12 month)

PV $3,000,000

time n

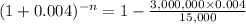

we clear for n as much as we can and solve

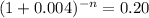

now we use logarithmic properties to solve for n:

![-n= \frac{log0.2}{log(1+0.004)]()

-403.16

this will be a value in months so we divide by 12 to get it annually

403/12 = 33,5833

we convert the residual to months:

0.5833 x 12 = 6.996 = 7 months