Answer:

Techron I $ 84,403.55

Techron II $ 70,526.47

Step-by-step explanation:

we will calculate the present worth for each millng machine and then the equivalent annual cost

Techron I

depreciation 261,000 - 47,000 = 214,000

214,000 / 3 = 71,333.33 depreciation per year

then we calcualte the tax shield:

71,333.33 x 35% = 24.966,67

70,000 operating cost:

tax shield for operating cost: 70,000 x 35% = 24,500

Annual cash outflow: 70,000 - 24,500 - 24,966.67 = 20,533.33

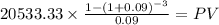

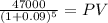

now we calculate the present value of a three years annuity of 20,533.33 discounted at 9%:

PV $51,975.9087

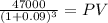

and the present value of the salvage value:

PV 36,292.62

Present worth:

261,000 + 51,975.91 - 36,292.62 = 276,683.29

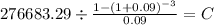

last, we claculate the PTM of an annuity which present value is 276,683.29

Equivalent Annual Cost

PV $276,683.29

time 3

rate 0.09

C $ 84,403.554

For Techron II we do the same:

net operaing cost:

depreciation tax shield: (455,000 - 47,000)/5 x 0.35 = 28,560)

operating cost after-tax 43,000 x (1-.35 ) = 27,950

net cash flow: 28,560 - 27,950 = 610 (is positive as the tax shield is greater than the operting cost)

present value of the cash inflow:

PV $2,372.6873

present value of salvage value

PV 30,546.78

Net Present value:

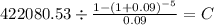

455,000 - 2,372.69 - 30,546,78 = 422080,53

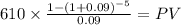

Equivalent annual cost:

PV $422,080.53

time 5

rate 0.09

C $ 70,526.473