Answer:

Statement a. is correct.

Step-by-step explanation:

The effective annual rate is always higher than the nominal interest rate, as the formula is clear for any number of periods, for any interest rate:

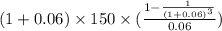

Effective Annual Rate of return =

Further if we calculate the present value of annuity due and ordinary annuity assuming 6 % interest rate, then:

Present value of annuity due =

= 1.06

$400.95

$400.95

= $425.0089

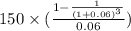

Present value of ordinary annuity =

= $150

2.6730

2.6730

= $400.95

Therefore, value of annuity due is more than value of ordinary annuity.

Statement a. is correct.