Answer:

In PV term, we are saving 7,633.33 dollars

Step-by-step explanation:

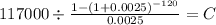

First, we calculate the PTm of the bank loan:

PV $117,000.00

time 120 months

monthly - rate 0.0025 (0.03 annual rate /12 months)

C $ 1,129.761

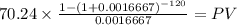

1,200 - 1,129.76 = 70.24

Each month we are saving 70.24 dollars

if this yield 2% we cancalcualte the present value of the savings:

C $70

time 120

rate 0.001666667 (0.02/12)

PV $7,633.6663