Answer:

Required rate of return is 14.99%

Step-by-step explanation:

Given:

Price of stock (Po)= $23.57

Dividend (Do) = $2

Growth rate (g)= 6% or 0.06

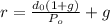

Using dividend growth model to calculate required rate of return:

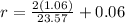

Substituting values in above formula, we get:

r =

= 0.1499 or 14.99%

Therefore, required return of company's stock is 14.99%