Answer:

C $ 3,113.036

Step-by-step explanation:

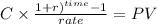

First step will be calcualte the future value of the bond and stock funds:

C 1,100

time 180 ( 15 years x 12 months)

rate 0.005833333 (7% divided into 12 months)

PV $348,658.5264

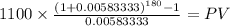

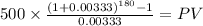

C 500

time 180

rate 0.003333 (4% divided by 12 months)

PV $123,045.2441

total fund: 348,658.5264 + 123,045.2441 = 471,703,7705

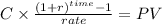

Then this will be placed to yield 5% and we will do motnly withdrawals:

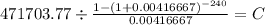

we need to calcualte the PTM of this annuity:

PV $471,703.77

time 240

rate 0.004166667

C $ 3,113.036