Answer:

the fund will be valued after 36 quarters: 443.027,75

Step-by-step explanation:

This will be an arithmetic progression with h = 500

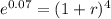

the continously rate we are going to convert to a quarterly equivalent rate:

![\sqrt[4]{e^(0.07)}-1 = r__(quarter)](https://img.qammunity.org/2020/formulas/business/college/l5a1ci4kulf7tq34a8nybd69p741s50dlf.png)

r = 0.017654022

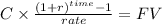

Then we calculate future value of an ordinary annuity of 1,100

C 1,100

time 36

rate 0.017654022

FV $54,682.8156

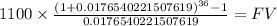

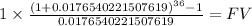

plus future value of the increases:

500/0.017654022 = 28,322.15773

Sn:i

FV 49.7117

n = 36

Sn:i - n = 13.7117

$28,322.15773 x 13.7117 = $388.344,93

Now we add both:

$54,682.8156 + $388.344,93 = 443.027,75