Answer:

Value of the Firm: $ 16, 117,737,003.06

Step-by-step explanation:

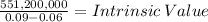

We need to calculate the present value of all the future cash flow of the company at his WACC.

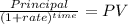

For the years 2020 and 2021 we will do the present value of a lump sum:

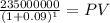

PV_2020 215,596,330.28

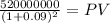

PV_2021 437,673,596.50

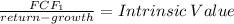

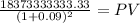

Now for the following cash flow, which are perpetuity, we use the Gordon model:

we know grow = 6%

and return = 9%

now for the FCF:

520,000,000 will be for the starting point (0) at which the dividends grow at a certain rate, we calculate next year:

we do 520,000 x (1+ g) = 520,000,000 x 1.06 = 551,200,000

we now solve:

18,373,333,333.33

As this is 2 years into the future we calculate the present value:

PV 15,464,467,076.28

We add them and get the total value of the company:

215,596,330.28

437,673,596.50

15,464,467,076.28

16, 117,737,003.06