Answer:

rounding to two decimal places: 11.11%

Step-by-step explanation:

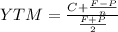

we can se the approximate formula for YTM

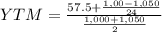

C= 57.5 (1,000 x 11.5%/2)

Face value = 1000

P= 1050 (market value)

n= 24 (12 years x 2 payment per year)

semiannual YTM = 5.4065041%

This is a semiannual rate as we consider semiannula payment.

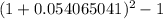

We need to convert into annual rate:

YTM 11.1053109921343000%

rounding to two decimal places: 11.11%