Answer: $50,846.3701

Step-by-step explanation:

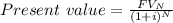

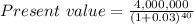

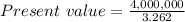

Need to save $4 million to live comfortably,

Interest rate, r = 3%

N = 40 years

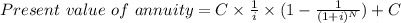

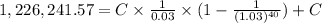

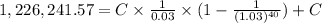

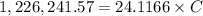

= 1,226,241.57

![1,226,241.57=C[(1)/(0.03)*(1-0.3065)+1]](https://img.qammunity.org/2020/formulas/business/college/8elg7uzjtq6vq7yqjirbpudgovodipnuw4.png)

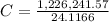

= $50,846.3701

Hence, $50,846.3701 will be the annual payment to have $4 million in the account on 65th birthday.