Answer:

Actual real after tax rate of return is 0.657%

Step-by-step explanation:

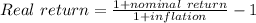

Use fisher method to compute real return:

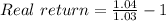

=0.00971 or 0.971%

Calculate after tax return as shown below:

Federal tax rate is 28% or 0.28 and state tax is 6% or 0.06.

After tax return = 0.00971×(1 - 0.28) ×(1 - 0.06)

= 0.00657 or 0.657%