Answer:

A- 99,817.75 dollars

B-701,686.93 dollars

C- implicit interest rate 8%

Step-by-step explanation:

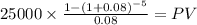

A.- we need to calculate the present value of an annuity of 25,000 for 5 years discounted at 8%:

C 25,000

time 5

rate 0.08

PV 99,817.7509

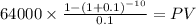

B.- we discount the coupon payment and maturity at 10% market rate

Coupon payment: 800,000 x 8%= 64,000

time: 10 years

rate 10% = 0.1

PV $393,252.2948

Maturity 800,000.00

time 10 years

rate 0.1

PV 308,434.63

PV copupon payment: $393,252.2948

PV maturity: $308,434.6315

Total $701,686.9263

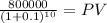

C we solve for the IRR using the excel IRR function:

we list the cashflows of the lease:

year 0 39,927

year 1 -10,000

year 2 -10,000

year 3 -10,000

year 4 -10,000

year 5 -10,000

we write: =IRR( and select the cell on which we list the cash flow and press enter

IRR = 0.08 = 8%