Answer:

Ans.

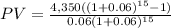

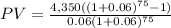

a) The value of the invesment of an annuity of $4,350, at 6% for 15 years is $42.248,28

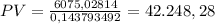

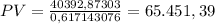

b) If it was for 40 years, the value of the investment would be: $65.451,39

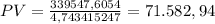

c) If it was for 75 years, the value of the investment would be: $71.582,94

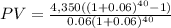

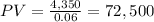

d) If it was forever, the value of the investment would be: $72.500

Step-by-step explanation:

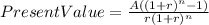

Hi, all we have to do is solve for "PV" the following equation for all the conditions of the problem, here is the equation.

Where:

A= Annuity or yearly payment ($4,350)

r = require rate of return, in our case 0.06

n= periods to pay

This equation can be used with all the questions of the problem but d) which requires that we use the following equation.

Now, let´s see how to solve all this step by step.

a)

b)

c)

d)

Best of luck