Answer:

Option 1 is more preferable.

Explanation:

As provided, the two options are:

Option 1

$5,000 today and $5,000 next year

The prevailing interest rate is 10%

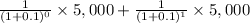

Therefore, present value of this option

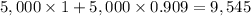

=

=

Option 2

Receiving $9,000 today straight once for all the dues.

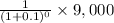

Its present value shall be

= 9,000

Since the net present value is more of option 1, the Option 1 shall maximize the value by $545 extra = $9,545 - $9,000