Answer:

the share should sell at $46

Step-by-step explanation:

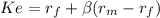

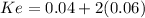

We use the CAPM method to know the required return of the capital

risk free 0.04

market rate 0.1

beta(non diversifiable risk) 2

Ke 0.16000 = 16%

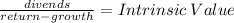

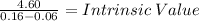

Now we calculate with the dividends grow model the intrinsic value of the share:

$4.6/0.1 = $46