Answer: $29,619

Step-by-step explanation:

Given that,

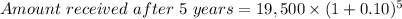

Investment = $19,500

Investment will generate(r) = 10 percent before-tax rate of return

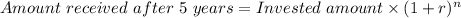

Tenure = 5 years

= $19,500 × 1.61051

= $31,404.945

Basis in stock = $19,500

Long term capital gain = Amount received - Basis in stock

= $31,404.945 - $19,500

= $11,904.945

Tax on gain = Long term capital gain × rate

= $11,904.945 × 15%

= $1,785.74

Cash retained = Amount received - Tax on gain

= $31,404.945 - $1,785.74

= $29,619.205

= $29,619

Therefore, $29,619 cash will Komiko retain, after-taxes.