Answer:

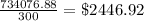

Monthly payments: $2446.92

Total expenditure: $734,076.88

Explanation:

As the compounding frequency is not stated, it is supposed to be annualy.

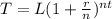

The total accumulated value T, including the loan L and the interest is given by the formula

where

L = Amount of the loan

r = nominal interest per year. In this case, 0.037

n = compounding frequency, in this case 1 year

t = the length of time the interest is applied. In this case, 25 years.

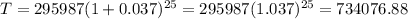

The total amount after 25 years will be

There are 25 times 12 = 300 months in 25 years, so the monthly payments would be

After the life of the loan, if there are no additional commissions or expenditures, you would have spent the amount of the loan plus interest, that is to say, the amount T previously computed

$734076.88