Answer:

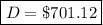

$701.12

Explanation:

Before doing the computing, notice that if we increase an amount D in,say, r%, it means that the new amount obtained is D+r% of D = D+(r/100)D = D(1+r/100).

That is to say, increasing an amount D in r% is equivalent to multiplying it by (1+r/100)

Taking into account that APR stands for Annual Percentage Rate, the amount we deposit will be increased 4% each year.

Generally, in this kind of loans the percentage is prorated monthly. That is to say, the money you have in the account will be increased in (4/12)%= 0.3333% each month.

Let D be the amount we are going to deposit each month.

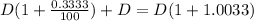

After the month 1 we will have the money increased in 0.3333% plus the new deposit

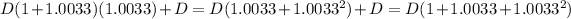

After the month 2 we will have the money we already had increased in 0.3333% plus the new deposit D

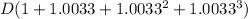

After the month 3 we will have, for the same reason,

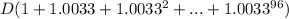

It can be noticed then, that after 18 years (96 moths) we will have an amount in the fund of

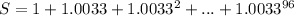

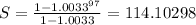

If we call

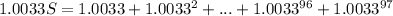

then

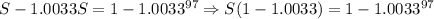

Subtracting the equations

and we have

So, after 18 years the amount in the fund will be

114.10298D

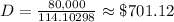

If we want this amount to be $80,000 then 114.10298D=80,000

So, the money we would have to deposit each month in a fund with an APR of 4% to accumulate $80,000 in 18 years, is