Answer:

price = $151.43

Explanation:

Given data:

dividend = $3.5M

Growth percentage = 7.3% per year

Number of share is 800,000

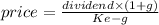

Price for stock can be calculated as

here,

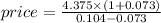

Ke = 10.4%

g = 7.3%

dividend per share

= $4.375 PER SHARE

= $4.375 PER SHARE

So we have

price = $151.43