Answer: $94,000

Step-by-step explanation:

At 10,000 units;

total cost = $10,000 × 10

= $100,000

At 20,000 units,

Total cost = 20,000 × 6.5

= $130,000

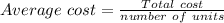

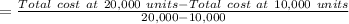

Variable cost per unit using high low method:

= $3 per unit

Hence,

Total fixed costs = Total cost at 20,000 units - (No. of units × Variable cost per unit)

= $130,000 - (20,000 × 3)

= $70,000

Hence total cost at 8000 units = (No. of units × Variable cost per unit) + Total fixed costs

= (8000 × 3) + 70,000

= $94,000