Answer:

$2,043,515.33

Step-by-step explanation:

EBIT = $376,000

Current cost of equity = 13.7%

Tax rate = 40%

Worth of stocks issued = $992,000

Coupon rate = 5.5%

Thus,

Amount of tax = 0.40 × EBIT

or

The amount of tax = $150,400

Therefore,

EAT = EBIT - tax

or

EAT = $376,000 - $150,400

or

EAT = $225,600

Now,

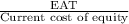

Value of unlevered firm =

or

Value of unlevered firm =

or

Value of unlevered firm = $1,646,715.33

Therefore, the value of levered firm = $1,646,715 + ( $992,000 × 40% )

or

The value of levered firm = $1,646,715.33 + ( $992,000 × 40% )

or

The value of levered firm = $2,043,515.33