Answer:

I will need to invest 64,669.73 dollars now.

Step-by-step explanation:

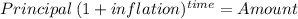

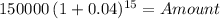

We will calcualte the future value of the cabin considering the inflation:

Principal 150,000.00

time 15 years

inflation 0.04000

Amount 270,141.53

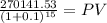

Then we calculate the present value of the lump sum at 15 years discounted at 10% which is the yield of the funds

Maturity 270,141.53

time 15 years

rate 0.10

PV 64,669.73

we would need to deposit 64,669.73 today to get enough cash to purchase the bcabin in 15 years.