Answer:

Applied Overhead is higher than actual overhead. Hence, manufacturing overhead is $ 4,000

Step-by-step explanation:

Given data:

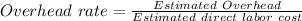

estimated overhead = $2,40,000

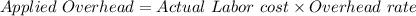

Labor cost =$2,80,000

Direct labor cost = $3,00,000

= $ 0.80 per direct labor cost

=$ 2,24,000

Actual Overhead cost = $ 2,20,000

Applied Overhead is more than actual overhead. Hence, manufacturing overhead is $ 4,000.