Answer:

inflation rate after 1 year is 5.00%

Step-by-step explanation:

expected inflation = 4.25%

risk-free rate (r) = 3.5%

Treasury bonds = 1-year yield plus 0.5%

to find out

what inflation rate is expected after Year 1

solution

we say that yield on 1st year treasury bond is here

r1 = r + inflation rate = 3.5 + 4.25 = 7.75 %

and in 3rd year bond bond value is

r3 = r1 + 0.5% = 7.75 + 0.5 = 8.25 %

and

r3 = r + inflation3

so inflation3 = 8.25 - 3.5 = 4.75 %

so

for 1st year inflation is = 4.25 %

and for 2nd year inflation is = I

and for 3rd year inflation is = I

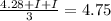

so mean of these

so I = 5.00 %

so

inflation rate after 1 year is 5.00%