Answer:

The share will sell for $16.31

Step-by-step explanation:

From the given information, the schedule of expected dividends is shown below:

Year Growth Dividend Calculation

0 1.6

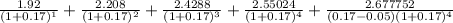

1 20% 1.6(1.2) = 1.92

2 15% 1.6(1.2)(1.15) = 2.208

3 10% 1.6(1.2)(1.15)(1.1) = 2.4288

4 5% 1.6(1.2)(1.15)(1.1)(1.05) = 2.55024

5 5% 1.6(1.2)(1.15)(1.1)(1.05)(1.05) = 2.677752

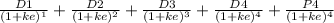

Price of the stock today =

.

.

where P4 =

Price of the stock today =

= $16.31

= $16.31