Answer:

The amount of money that should be invested at the rate of 5.25% is $12,000 and the amount money that should be invested at the rate of 4% is $13,000

Explanation:

we know that

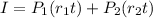

The simple interest formula is equal to

where

I is the Final Interest Value

P is the Principal amount of money to be invested

r is the rate of interest

t is Number of Time Periods

Let

x ------> the amount of money that should be invested at the rate of 5.25%

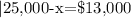

25,000-x -----> the amount money that should be invested at the rate of 4%

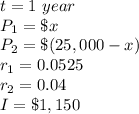

in this problem we have

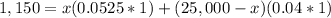

substitute in the formula above

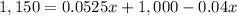

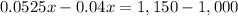

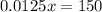

Solve for x

therefore

The amount of money that should be invested at the rate of 5.25% is $12,000 and the amount money that should be invested at the rate of 4% is $13,000