Answer:

20%

Step-by-step explanation:

Data provided:

Direct labor cost = $30,000

Direct materials cost = $50,000

Factory overhead applied = $6,000

Now,

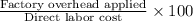

The overhead application rate is given as:

Overhead application rate =

therefore,

Overhead application rate =

or

Overhead application rate = 0.2 × 100% = 20%