Answer: $7.50

Step-by-step explanation:

Given that,

Total value = $950 million

Accounts payable = $100 million

Notes payable = $100 million

Long-term debt = $200 million

common equity = $200 million

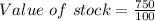

shares of common stock = 100 million

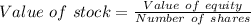

Value of equity = Value of firm - Value of preferred stock - Value of long term debt.

= $950 million - 0 - $200 million

= $750 million

= $7.50