Answer:

how long could you receive payments of $20,000 per year?

for almost 5 years. (4.93)

It could be made 4.93 withdrawals of 20,000

which means 4 of 20,000

and one for 9% of 20,000 = 18,600

Step-by-step explanation:

we should consider how many years can the prize fund the new business start-up period of 20,000 dollars per year

considering it can yield 10% per year.

we need to sovle for time in an annuity:

C $20,000.00

time: n years

rate 0.10

PV $75,000.0000

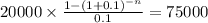

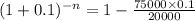

Now, we solve for what we can:

And apply logarithmics properties to solve for n

![-n= \frac{log0.625}{log(1+0.1)]()

-4.931305661

4.93