Answer: 35.71%

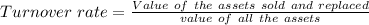

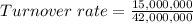

Step-by-step explanation:

Value of assets sold and replaced(D) = Stock × Share price

= 600,000 × $25

= $15,000,000.

Value of all assets = (Stock × Share price) of A + (Stock × Share price) of B + (Stock × Share price) of C + (Stock × Share price) of D

= (200,000 × $35) + (300,000 × $40) + (400,000 × $20) + (600,000 × $25)

= $42,000,000

= 0.3571

= 35.71%