Answer:

Required rate of return= 14.8

If the security is expected to return 15%, it is underpriced.

Step-by-step explanation:

The required rate of return on the security can be calculated using the CAPM formula which states that

Required rate of return =rf + B(rm - rf)

where rf= risk free rate

B= beta of the security

rm = return on the market

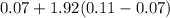

Required rate of return =

= 14.68%

= 14.68%

If the security is expected to return 15%, it is underpriced, and is a good investment. Discounting the expected cash-flows from the security at this higher expected return of 15% is going to yield a lower price compared to what the investor is prepared to pay given his required rate of return of 14.68%.