Answer:

The market price should be: $114.67

Step-by-step explanation:

the risk free rate is 2.00%

this firm has a spread of 0.85%

firm cost of debt 2.85%

The market will adjust the bond price so the yield ofthe bonds relfect this rate.

So we will calculate the present value of a coupon 100 with a 6% rate

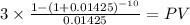

We use the ordinary annuity for the coupon payment:

Coupon payment: 100 face value x 3% bond rate = 3

time 10 (5 years with 2 payment per year)

market rate: 0.01425 (2.85%/2)

PV $27.7768

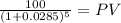

and lump sum present value for the maturity:

Maturity 100

time 5

rate 0.0285

PV 86.89

Last, we add them to get the market price:

PV c $27.7768

PV m $86.8917

Total $114.6685