Answer: (a) 6%

(b) 10.61%

(c) Yes

Step-by-step explanation:

a) After tax cost of debt = Yield (1- tax)

= 8 ( 1 - 0.25)

= 8 × 0.75

= 6%

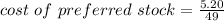

b)

= 0.1061 or 10.61%

Note: Cost of preferred stock is not tax deductible

c),Yes the treasurer is correct ,The cost of debt is 5% less than cost of preferred stock [10.61 - 6 = 4.61%]