Answer:

The amount needed in the retirement account is $707,025.

Step-by-step explanation:

This problem is a case of annuity.

They plan to withdraw $ 75,000 annually from the end of the first year of retirement.

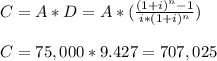

The formula that relates capital in the account to annual withdrawals is