Answer:

the solar panels need to operate 11,636.66 hours to brak even

at 10,473 hours per year the project don't break-even It will need a grant for 170.026,74 dollars to do so.

Step-by-step explanation:

300 kilowatts x 0.1 = 30 dollars of saving per hour:

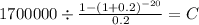

we need to find the couta of a present value of 1,700,000 for 20 years at 20% discount rate:

PV $1,700,000.00

time 20

rate 0.2

C $ 349,106.102

Each hour saves 30 dollars

so 349,106.10/30 = 11.636,87 hours

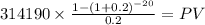

IF the solar panels operate 10,473 hours per year then:

C 314,190

time 20

rate 0.2

PV $1,529,973.2565

the present value of the panel is 1,529,973.26

The university would need a grant for 170.026,74