Answer:

It is feasible. 16,012.47 dollars

Step-by-step explanation:

We will calculate the present value of the increased productivity and the salvage value.

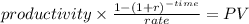

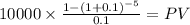

The productivity will be done with an ordinary annuity

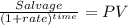

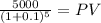

while the salvage with a lump sum

productivity: 10,000

n = 5 years

MARR = 10%

PV $37,908

Salvage: 5,000.00

time 5 years

MARR = 10%

PV 3,104.61

Then we calcualte the NPV which si the sum of the cash inflow or cash savings after subtracting the investing cost at year zero:

Net present value: $37,907.8677 + $3,104.6066 - 25,000 = $16,012.4743

it wil be feaseble as his NPV is positive.