Answer:

Dividend yield for W = 5%

Dividend yield for X = 15%

Dividend yield for Y = 20%

Dividend yield for Z = 4.6%

Step-by-step explanation:

For a constant growth stock

If r is made subject of formula; r=

= div yield + growth rate

= div yield + growth rate

For Stock W, given r = 15% and g= 10%; dividend yield = 15%-10%=5%

For Stock X, given r = 15% and g= 0%; dividend yield = 15%-0%=15%

For Stock Y, given r = 15% and g= -5%; dividend yield = 15%-(-5)%=20%

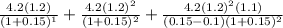

For Stock Z, the price of the stock today is calculated as follows:

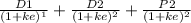

Price of the stock today =

.

.

where P2=

Price of the stock today =

=109.57

=109.57

Therefore dividend yield =

=

=

4.6%

4.6%