Answer:

17.00 percent

Step-by-step explanation:

Preferred equity is an ownership interest in a company. However, preferred does not carry any voting right like the common equity.

The formula for calculating the cost of preferred equity for the 100 preferred stocks is follows:

Where,

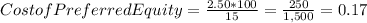

Preferred Dividend Per Share = $2.50

Price Per Share = $15

Therefore,

Expressing 0.17 as a percentage by multiplying it by 100, we have:

Cost of Preferred Equity = 0.17 * 100 = 17.00 or 17.00 percent.

I wish best of luck.