Answer:

A. 12.6

Step-by-step explanation:

Required rate of return of Stock is calculated as below:

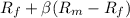

=

In this equation,

= Risk free rate of interest on long term bonds, here it is 6% on T-Bonds.

= Risk free rate of interest on long term bonds, here it is 6% on T-Bonds.

= Beta defined for the security, here, it is value of 1.2

= Beta defined for the security, here, it is value of 1.2

= Expected rate of return on market = 11.5%

= Expected rate of return on market = 11.5%

Now, putting each individual value in the formula we have,

= 6% + 1.2 (11.5% - 6%)

= 6% + 6.6%

= 12.6%