Answer:

a. 7,900

b. 10,100

Step-by-step explanation:

As for the provided information,

We know at break even point taxes shall be = 0 as there are no profits and no losses.

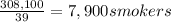

a. At break even: =

Fixed Cost = $308,100

Contribution per unit = Selling price - Variable cost = $79 - $40 = $39

Therefore, break even units =

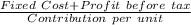

b. In case the company wants a profit of $51,480 after tax @ 40% then,

Earnings before taxes =

= $85,800

= $85,800

Therefore, number of units =

=

= 10,100

= 10,100