Answer:

As the first payment occurs on option 7 n interest rate higher enough can make the 50 dollars received first make the difference.

The switch produced at a rate of :

300%

Interest rate below this mark favor option 6

while higher than this favor option 7

Step-by-step explanation:

Option 6

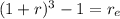

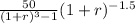

perpetuity of 100 discounted 1.5 year

perpetuity of 50 every 3 years discounted 3 years

as the payment are every three years we calcualte an equivalent rate:

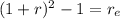

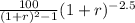

Option 7

perpetuity of 50 discounted 1 year

perpetuity of 100 every 2 years discounted 2.5 years

equivalent biannual rate

having the formulas

we can do it on excel solver to look at which rate the switch produces