Answer:

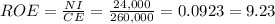

ROE = 9.23%

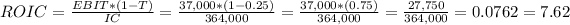

ROIC = 7.62%

Step-by-step explanation:

Data:

Net Income NI = $24,000

Interest Expense IE = $5,000

Tax Rate T = 25% = 0.25

Notes Payable NP = $24,000

Long-term debt LTD = $80,000

Common Equity CE = $260,000

Return On Equity ROE = ?

Retrun On Invested Capital ROIC = ?

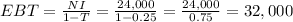

Earnings Before Taxes EBT = ?

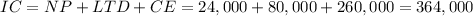

Invested Capital IC = ?

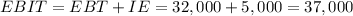

Earnings Before Taxes and Interest EBIT = ?

Calculations:

%

%

%

%

Hope this helps!