Answer:

It will be recorded at 13,085,320.86

Step-by-step explanation:

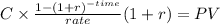

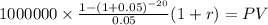

We will calculate the present value of an annuity-due of 20 years to know the lease liability

C 1,000,000

time 20 years

rate 0.05

PV $13,085,320.8597

It will be recorded at 13,085,320.86

at year-end interest will be recognize and icnrease the liability accouny

on january first will decrease the liaiblity by the 1,000,000 payment.