Answer:

present value of the prize: 4,451,822 dollars

Step-by-step explanation:

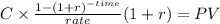

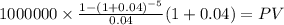

we will calcualte the present value of an annuity-due of 5 payment of 1,000,000 discount at 4%

C 1,000,000

time 5

rate 0.04

PV $4,451,822.3310

This will be the present value of the prize today