Answer:

Ans. Your monthly payments will be $1,602.37 ; The effective annual rate is 5.33%

Step-by-step explanation:

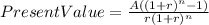

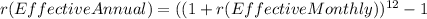

Hi, first, we need to convert this APR rate into an effective monthly rate, that is, dividing 0.052/12 =0.00433 (or 0.4333%). Then we need to use the following equation and solve for A.

Where:

PresentValue= 84,500

A = periodic payments (the monthly payments that you need to make)

r = 0.004333333

n=60 months

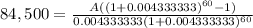

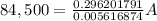

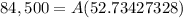

So, let´s solve for A.

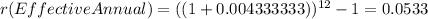

Now, in order to find the effective annual rate, we need to use the following equation.

Notice that to find an effective rate you have to start with another effective rate, otherwise it won´t work. So everything should look like this.

Meaning that the equivalent effective annual rate to 5.2% APR is 5.33% effective annual.

Best of luck.