Answer:

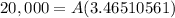

Ans. The annual payment to repay the loan at 6% annual, for 4 years is $5,771.83

Step-by-step explanation:

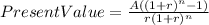

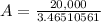

Hi, in order to find the annual payment o the loan, we need to use the following equation and solve for "A".

Where:

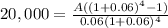

Present Value = Money loaned (in this case, $20,000)

A= Annual payments

r= interest rate (in our case, annual)

n = Number of periodic payments (4 payments, 1 each year)

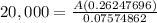

Everything should look like this.

Best of luck.