Answer:

A) Dee´s Margin = 58.33%; B) Remaining Margin if price drops to $26 is 30.56% C) She won´t receive a margin call (but close...)

D) Rate of Return = - 32.36%

Step-by-step explanation:

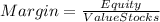

Hi, first let´s find out what the initial margin is, for that we have to use the following formula.

Now, in order to find the equity, we have to find the total value of the stocks and substract the debt from it, since it was 300 shares at $30 per share, the total value of the investment is $7,800, therefore, its equity is $3,300 ($7,800-$4,500).

So everything should look like this

So the initial margin was 58.33%

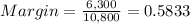

If the price drops to $26 by the end of the year, the remaining margin in her account is:

So the remaining margin one year later, after the stock price dropped to $26 was 30.56%

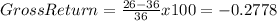

Now, in order to find the rate of return on her investment, at the end of the year, we have to remember that the money loaned was at 11%, therefore, the best way to find out the return of this investment is to convert this into money, like such.

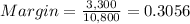

First (Gross Return of the stock)

Ok, we have the gross return, which is -$27.78%

The interest expenses are just as follows.

To find the return on the investmen, we need to use the following formula.

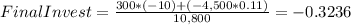

The final investment is: Gross return($)+interest Expenses

This means that, by the end of the year, her return on the investment was -32.36%. In money, this is - $3,495.

Best of luck.