Answer:

The monthly savings considering the inflation will be for 35,089.94 dollarsper month

Step-by-step explanation:

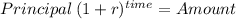

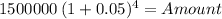

the cost of the equipment will be

Principal 1,500,000.00

time 4 years

inflation 0.05000

Amount 1,823,259.38

This is the future value we need to reach in order to pay the medical equipment at once.

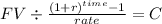

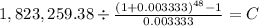

We will calculate the couta of a future value of 1,823,259.38 with 48 monthly payment at 4% annual interest rate:

FV $1,823,259.38

time 48

rate 0.003333333

C $ 35,089.942