Answer:

WACC without taxes = 6.84% (rounding up to two decimals)

WACC with a tax rate of 21%= 6.27% (rounding up two decimals)

Step-by-step explanation:

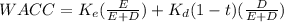

To calculate WACC we need to know the weight's for equity adn debt:

Equity: 24,000,000 x 13 = 312,000,000

Debt 368,000,000

Value: 680,000,000

Debt weight's 368M/680M = 0.458823529

Equity weight's 312M/680M =0.541176471

Now we have he weights can calculate the WACC

Ke 0.09

Equity weight 0.458823529

Kd 0.05

Debt Weight 0.541176471

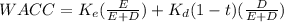

t 0 (as this is a pretax, tax is zero)

WACC 6.83529%

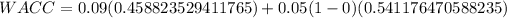

then, for b we are asked for a 21% tax rate, everything else remains unchanged:

if t = 21% then:

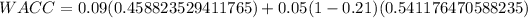

t 0.21

WACC 6.26706%